Dealing with a foreign country’s corporate tax regime can be challenging, as national and local tax administration varies from country to country. Though that of Republic of Korea (the “Korea”) is fairly standard, as a foreigner interested in either establishing a subsidiary, opening a branch office, or starting a venture in Korea, you may find it helpful to have a base understanding of how corporate income tax works as well as what types of tax deductions are possible in Korea.

Korea’s corporate tax, in one form or another, is levied on corporations that are resident corporations, corporations having its head or principal office, or effective management in Korea, and on non-resident corporations. An important distinguishing characteristic between these resident corporations and non-resident corporations is that the former are taxed on worldwide income, whereas the latter is only taxed on Korean-source income via a withholding tax.

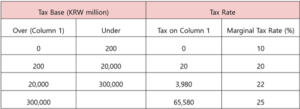

The following table shows the standard Korean corporate income tax rates for each tax base (in KRW million):

Depending on what tax base it finds itself in, a foreign corporation may also be subject to an alternative minimum tax (AMT), a mandatory supplement tax levied on high-income corporations. Designed to ensure that high-earning corporations make a baseline tax payment, which they could otherwise avoid by claiming various tax deductions, the ATM is calculated by adding tax preference items―for example, interest on private activity municipal-bonds, qualified small business stock exclusion―back into the corporation’s taxable income.

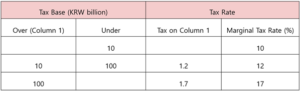

The following table shows the AMT rates per tax base after the reinclusion of tax preference items (in KRW million):

For SMEs, the minimum tax is the greater of 7% of taxable income before certain tax deductions and credits or actual CIT liability after the deductions and credits. For middle market companies that exceed the size of SMEs (so-called ‘medium-scale companies’), an 8% minimum tax rate is applicable for the first three years, starting from the year when the size exceeds an SME for the first time, and a 9% rate is applicable for the next two years.

Though it only applies to a small fraction of companies, also note that there is an Additional Tax on Corporate Income that applies to corporations whose net assets exceed KRW 50 billion (excluding SMEs) and companies subject to restrictions on cross-shareholdings under the Act on Monopoly Regulation and Fair Trade.

The tax reform, originally intended to be terminated by the end of December 2017 before being extended until the end of December 2022, imposes a supplementary tax of 20% on corporate income.

It is also important to note that when a corporate taxpayer claims certain tax credits or exemptions under the Special Tax Treatment Control Law (STTCL), they will be subject to a 20% agriculture and fishery surtax on reduced tax liability. This is primarily to cover the corporate tax exemptions agricultural and fishery industries are afforded under the same legislation.

While possessing basic knowledge on South Korea’s tax system is imperative to successfully operating a corporation in the country, equally important is having a solid understanding of its policies on certain taxpayer practices, such as transfer pricing and thin capitalization.

Transfer pricing is one of the most pressing international tax issues among businesses engaged in cross-border inter-company transactions. Defined as “the price charged by one member of a multinational organization to another member of the same organization for the provision of goods or services or the use of a property, including intangible property”, transfer pricing–when used in a particular way–can allow companies to reduce their overall tax expenses by strategically shifting tax burden between branches in different countries with differing tax rates.